Gain in-depth knowledge of taxation concepts and practical skills with Hamzah Academy’s ACCA TX course, designed to help you succeed in your ACCA qualification.

Hamzah Academy is a premier institution for ACCA qualification preparation, specialising in comprehensive Taxation (TX) course delivery. Our expert instructors bring real-world tax expertise to every session, ensuring students master complex concepts through practical application. With industry-leading pass rates and flexible learning options, we’ve helped thousands of aspiring accountants achieve ACCA success. Hamzah Academy’s personalised approach combines innovative teaching methodologies with dedicated support systems, creating an optimal environment for professional development. Join our community of successful ACCA professionals and transform your taxation knowledge into career advancement.

Our ACCA Taxation (TX) course delivers comprehensive training to navigate complex tax principles confidently. At Hamzah Academy, we’ve structured this program to systematically build your taxation expertise while preparing you for exam success. Our course combines theoretical foundations with practical applications, focusing on UK and international tax frameworks. Students benefit from structured learning paths, regular progress assessments, and personalised feedback from experienced tax professionals. Whether pursuing a career in tax advisory, compliance, or general accounting, our TX course equips you with the technical knowledge and analytical skills employers demand. Join the thousands of successful candidates who have trusted Hamzah Academy to guide their ACCA qualification journey.

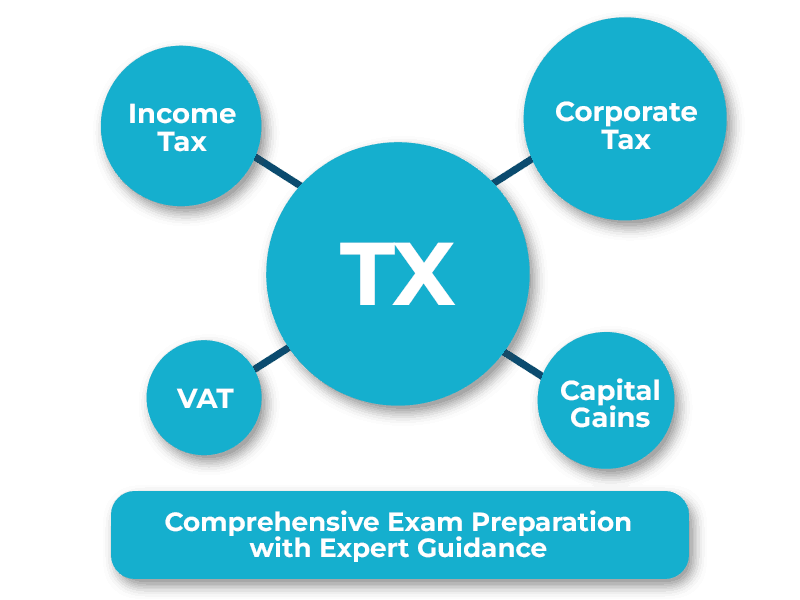

The TX syllabus covers essential taxation principles and their practical application across various scenarios. You’ll master income tax calculations for individuals, understanding allowances, reliefs, and computing taxable income from employment, business, and investments. Our course thoroughly explains corporate tax frameworks, helping you accurately determine taxable profits and calculate corporation tax liabilities. You’ll develop expertise in capital gains tax computations for individuals and businesses, including available exemptions and reliefs. The course explores VAT registration requirements, taxable supplies, and return preparation. Additionally, you’ll gain competence in inheritance tax principles and administration procedures for the UK tax system. Each topic is presented through real-world examples, ensuring you can apply theoretical concepts to practical scenarios – the key to exam success.

Mastering TX requires more than just understanding tax principles – a strategic exam approach is crucial. At Hamzah Academy, we provide proven techniques for tackling the TX paper efficiently. You’ll learn effective time management strategies, helping you allocate appropriate minutes to each question based on mark value. Our expert instructors demonstrate how to identify requirements, plan structured responses, and avoid common pitfalls that cost marks. We focus on developing your computational accuracy while building the critical reasoning skills for scenario-based questions. Through targeted mock exams and practice sessions, you’ll become proficient at recognising question patterns and applying relevant tax rules confidently. Our students consistently outperform exam averages by implementing our systematic approach to problem-solving and clear presentation of answers that examiners reward.

Hamzah Academy provides comprehensive study materials designed specifically for ACCA TX success. Our premium resource package includes detailed course notes covering all syllabus areas, which are regularly updated for the latest tax regulations and exam focus. Students receive extensive question banks with fully worked solutions, helping reinforce concepts through practical application. Our interactive online platform offers topic-based quizzes, allowing you to test your understanding progressively throughout your studies. You’ll access recorded tutorial sessions for flexible learning, complemented by printable summaries of key tax rates and deadlines for quick reference during revision. Our TX package includes exclusive examiner-style practice tests with performance analytics to identify your strengths and areas for improvement. Supplementary resources include tax computation templates and memory aids for efficient recall during your exam preparation.

Qassim Mushtaq brings years of taxation expertise to Hamzah Academy’s ACCA program. As a qualified chartered accountant with specialised experience in UK and international tax frameworks, Qassim combines theoretical knowledge with practical insights from his senior roles at leading accounting firms. His teaching methodology emphasises real-world application of complex tax principles, helping students bridge the gap between exam requirements and professional practice. Qassim’s students consistently achieve pass rates significantly above global averages, attributing their success to his clear explanations, comprehensive study materials, and personalised approach to addressing challenging concepts.

TX (Taxation) is a key applied knowledge level paper for the ACCA qualification. It focuses on developing your understanding of tax systems and preparing computations of tax liabilities for individuals and businesses. The course covers income tax, corporation tax, capital gains tax, inheritance tax, and VAT within the UK taxation framework, providing essential knowledge required for professional accountancy practice.

The ACCA TX exam is three hours long. This includes reading and planning time, which allows you to understand the requirements and thoroughly structure your answers. The exam consists of Section A, with 15 objective test questions (worth 30 marks), Section B, with 3 scenario-based questions (worth 10 marks each), and Section C, with 2 case studies (worth 20 marks each).

Section C of the ACCA TX exam comprises two 20-mark case studies that test your application of tax knowledge to complex scenarios. These questions typically present real-world situations requiring comprehensive tax analysis across multiple tax heads. Section C assesses your ability to integrate different areas of taxation, provide detailed computations, and offer reasoned advice to clients based on the specific scenario presented.

ACCA Taxation can be challenging due to its detailed regulations and frequent legislative updates. However, with structured study and proper guidance, it's entirely manageable. Many students find the TX moderately difficult compared to other papers. The key to success lies in understanding core principles rather than memorising rules, practising numerous questions, and developing computational accuracy. At Hamzah Academy, our specialised teaching approach makes complex tax concepts accessible.

The "easiest" ACCA paper varies among students depending on their background and strengths. Many find papers matching their prior education or work experience more approachable. Some students consider FA (Financial Accounting) and MA (Management Accounting) relatively more straightforward among the Applied Knowledge level papers. Rather than focusing on which is easiest, we recommend approaching each paper with dedicated study strategies tailored to its unique requirements.

The TX UK exam follows a three-section structure:

All questions are compulsory. The exam tests computational skills and knowledge of tax principles, emphasising practical application to real-world scenarios. Section A typically covers the breadth of the syllabus, while Sections B and C test a deeper understanding of specific taxation areas.

On-demand courses consist of pre-recorded lessons, allowing learners to study at their own pace.

Premium Courses are live, instructor-led sessions conducted weekly via Zoom, followed by recording.